For the last few years, the EOMs’ strategy was to transit from a car manufacturer to a “mobility provider”. Although in my view, these catchy terms such as “mobility provider” or “MaaS” have as many definitions as players, I have always believed this strategy pursued by the manufacturers as not the best fit for the future mobility value chain.

OEMs should not aim to be a “mobility provider”

Considering recent news such as the step back of the NOW carsharing program, the strategic orientation of BMW to focus more on manufacturing stuff, the new opportunities explored by FCA with Foxconn and many other examples make me feel that 2020 is the year during which OEMs will finally move towards what I believe is the right direction. Here is why in a few non-exhaustive points summarized below (hey if I disclose all the knowledge we gather through my consulting job, why would you commission us afterwards 😅).

- OEMs DNA = B2B not B2C: Car manufacturers should stick to their core business and produce vehicles;

- The mobility triggers are changing: Mobility is gathering an increasing amount of companies from different industries such as tech and, due to competition consolidations, only the ones strong and focused on what they do best would survive;

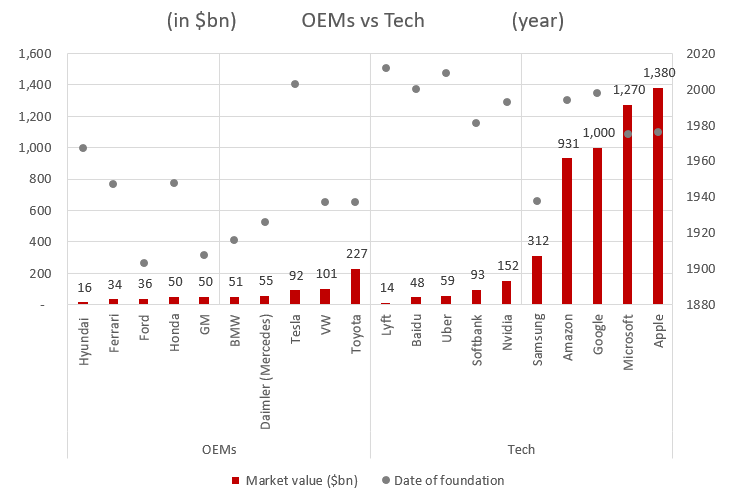

- Not the biggest fish in the bowl anymore: On average, OEMs are half a century older than tech companies and are worth up to 20 times less;

- Smashed between a multitude of hammers: traditional car manufacturers are not (or won’t be) the only one able to perform well on this specific part of the mobility value chain. New players are threatening this conservative part of the industry and might severely harm the brands we all know.

OEMs DNA = B2B not B2C

Let’s be clear: Original Equipment Manufacturers are B2B and not B2C companies. Although I often hear people say that brands such as BMW & co would be great at dealing directly with end-users, allow me to disagree with this opinion. It is true that OEM brands are well-known to the public, but it does not mean they have the knowledge to sell directly to their end-customers. There’s an intermediary often forgotten in the middle: the dealership! So, without going into too many details (happy to further expend if you want), there’s no need to go against the true nature of these companies’ business model which is at the end of the day putting together pieces of metal…

OEMs should stick to the definition of their job

My advice for them is just “stick to the definition of your job” which is, according to Cambridge Dictionary “a company that makes parts and products for other companies which sell them under their own name or use them in their own products”.

The mobility triggers are changing

For over a century, mobility was all about technical stuff such as chassis or engine, performance, design, private ownership … In the near future, what will define mobility will be non-exclusively software, user experience, safety and sharing. This is why the mobility industry is a nascent massive ecosystem that will attract a multitude of industries such as automotive, telecom, data, technology, real estate, cybersecurity, …

In a fast expanding industry, successful companies would be the ones focused on their core business

In this expanding environment, I think the companies who will succeed in the future will be the ones which arduously focus on their core business model. Due to an ongoing and certainly increasing consolidated market, players will disappear and only the strongest in their segment would sustain.

Not the biggest fish in the bowl anymore

OEMs used to be amongst the biggest fishes in the automotive bowl. Today, the multiplication of opportunities enabled by the new triggers allows different stakeholders from the tech industry to develop mobility services. The problem for OEMs is, these players are… massive! So why do OEMs try to compete with them? Look at Daimler and BMW investment of $1bn in mobility services or VW trying to raise its maker cap to $200bn. While judging whether competing against tech companies is a good idea or not (I believe it is not but you may have a different opinion), it has the merit to be funny when you crunch some data (I guess you know by now I like facts to support my opinion 😊):

Source: Data collected on the 17/01 and aggregate by your servant 😊

Even if we consider 10% of the tech company market caps allocated to mobility-related projects, they would still remain bigger than the biggest OEMs…

Here’s the list of the top 10 biggest OEMs compared with a few tech companies influencing significantly the mobility industry (ok, Softbank is not a tech company, but it still shakes the industry, doesn’t it?). I am not sure whether a lot of comments is necessary to support how different the sizes are. I already hear you saying that, for example, Google is doing a lot of stuff that is not related to mobility. Ok, I hear your point but even if we consider 10% of their market cap coming from mobility, they still remain at least as big as OEMs…

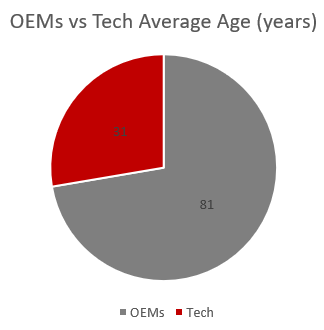

On average, an OEM is half a century older than a tech company!

Now let’s have a look at their respective founding year. The average OEM foundation date is 1939 whereas for Tech it is 1988. On average a tech company is half a century younger than an OEM!

It is interesting to note that, except for Tesla, the biggest car manufacturers are also amongst the oldest. This trend seems to be reflected by tech companies. We can then only imagine the progression curve ahead of the youngest tech companies such as Uber, Lyft or Baidu… Another interesting fact is that Tesla is probably the only tech/ car manufacturer and is ranked 3rd (or 2nd?) in the world… Can you imagine the future valuation of nascent Asian incumbents wanting to compete with Tesla?

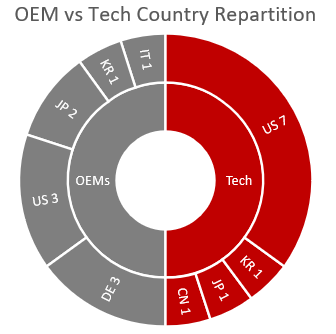

The future mobility power could relocate in the US and Asia, leaving EU with the leftovers

Finally, if we look at where the “business power” is held, we might expect a movement of the core industry in terms of location.

In the current automotive industry, the balance between Asia, the EU and the US is quite respected. For the tech industry, it is another story… In the above selection, there are no EU players whereas US firms are massively above the majority. I agree, my selection may not be fully representative of the tech/ mobility landscape (and we are working on a piece of research that will be representative with 600+ companies!) but it still shows a possible future trend.

Smashed between a multitude of hammers

“The grass is not greener in the neighbour’s garden”. This old French adage could be well applied to the mobility industry. I firmly believe that there are plenty of opportunities for car manufacturers to remain profitable in their own garden. Yes, with shared mobility and new transportation behaviours the number of cars on our street would probably stall if not decrease (well, as I explained in another article, I am not really convinced by this forecast and a recent study evaluated the number of cars by 2035 as twice as today to 2bn…). But there will be other opportunities.

First, a higher vehicle utilisation rate might be a synonym to a higher [replacement] turnover. Second, new vehicles will enter the market, and someone will have to build them (pods, shuttles, shared-specific vehicles, …).

Traditional OEMs should reinforce their manufacture position to avoid being squeezed between EV/AV Start-ups, tech manufacturers (i.e. Foxconn & co) and Asian manufacturers

Third, OEMs are the only players in the mobility value chain, at the moment, able to put together pieces of metal at an industrial and global scale. Isn’t that already a sufficient competitive advantage to try to secure? By trying to diversify their activities with carsharing, ridehailing, pooling, micromobility and traditional car manufacturing, OEMs might simply weaken their position. They are indeed diluting their resources (time, people, money, …) in a multitude of projects (i.e. developing traditional cars, EVs, AVs, MaaS, …). A fierce and extremely well-developed pool of possible competitors is waiting at the doorstep of this part of the value chain to capture additional value-added to their own business. I am talking about the white-label technology manufacturers (ODMs) such as Foxconn that are able to produce in a very large quantity and high-quality level pieces of technology at a global scale. It may sound crazy and unrealistic at the moment, but let’s see in the next coming years (FCA seems to agree with this vision though!). I also include Asian and more specifically Chinese car manufacturers who are founded to build cars of the future (EV, AVs and shared). They do not waste their money in developing almost outdated vehicles such as Petrol SUVs. And I am not forgetting Easymile, Waymo and all other EV/AVs manufacturers having certainly more expertise in this field than traditional OEMs. The last threat might come from the air. Would the aviation industry be too small for Airbus and Boeing one day (due to factors such as sustainability, new transport modes competing with short and medium hall flights, …) that they would like to expand in the mobility industry? After all, they know how to build machines to transport people, don’t they? Would you be shocked to be driven by an autonomous pod labelled Airbus in an airport?

So my advice in one word is “focus, focus, focus and focus again”.

What if the mobility industry follows the Airline path?

I have always thought that comparing the airline industry with automotive/ mobility is an interesting exercise. Aircrafts are 95% of their operating time in an autonomous mode and carry millions of people every day without no, or few, passenger apprehension and accident. Perhaps the automotive industry [oups, mobility industry] should get inspired by how this sector managed to get to that automated point in a smooth way [in our study Being Driven we suggest some ideas to increase AV awareness and adoption].

Planes are 95% of the time autonomous, move millions of people daily and are the safest mode of transport in the world. Can’t we learn something from this industry for mobility?

What is a fact from a long industrial evolution is the duopoly formed by Airbus and Boeing (ok I admit, Boeing is having a hard time but still!). There’re only two companies, consolidated with a multitude of smaller players, that manufacture planes for an entire massive industry. I am not saying the mobility industry should or would tend to a duopoly, but I still believe in a market consolidation to a few competitors and it is still an interesting comparison to learn some lessons, isn’t it?

Again, this is not a holistic review of all the points in favour of my vision and at the end of the day, it is just my personal opinion.

As always, share your vision and engage with me! 😊

About Me

Frederic is a Consultant at Neckermann Strategic Advisors. He holds an MBA from Imperial College London Business School and a Master’s Degree in Business Engineering from UMons. He supports companies in understanding how the Mobility Revolution will change their business. Frederic is the co-author of multiple smart mobility research reports and one of the contributors to the Global New Mobility Coalition led by the World Economic Forum. He is also a mobility guest lecturer at Universities, a blogger @ Frederic-john.com and mentors mobility start-ups in London and Singapore. He is fluent in French and English and also speaks some Spanish and Dutch.

The views expressed in this article are personal and do not represent the opinion of my employer or any other parties I am involved with. The suggested insights come from my discussions, research and analyses.