Coronavirus as a trend accelerator

Who would have ever been able to forecast how 2020 started? I still remember the positive and numerous resolutions taken by people in January, including me. So, let’s move forward and keep this positive energy!

The COVID19 is significantly impacting our lives. People are moving less and there are more goods delivered. OK, I guess like me you’re a bit exhausted with this speech so let’s move on. I think it is not too early to pause and reflect on what happened in the smart mobility sector to put some lights on its near-future.

The Mobility Revolution Drivers

We should focus on the Mobility Revolution drivers to assess the COVID19 impacts on the transport industry

When I started to look at how the pandemic is impacting the urban transport industry, I began with the Mobility Revolution drivers. There are many of them but I selected what are for me the six most important ones: Congestion, pollution, people, regulation, infrastructure and technology.

Technology, regulation and infrastructure are the most negatively impacted mobility drivers. Before the crisis, they were also the easiest ones to leverage and develop the industry

I was surprised to realise the drivers being technology regulation and infrastructure, which were the easiest and most effective levers to pull the industry up prior to the crisis, are now the most negatively impacted by the virus.

Technology

Less money available to finance everything and nothing at the same time but still enough for good projects with an appropriate team

Before the COVID19, there was a significant amount of money invested in the smart mobility world to support technology developments. $220 bn have been invested since 2010 in new mobility start-ups including $33+ bn only for 2019. What about 2020 and the coming years? Who knows, but my feeling is there will still be tons of money for good companies proposing a relevant project with an appropriate team. In March 2020, Waymo raised $2.25 bn and DiDi $300 mn. More secretly, Neolix, which are taking a sort of leadership in the autonomous grocery delivery in China, raised the same month $29 mn. More interestingly, these funds are coming from different investors, showing how diversified mobility investors can be. So, yes there will be an overall slow down in R&D due to fewer investments but certainly not a lower quality in terms of projects developed.

Regulation

Regulators might be busy with other priorities

Already struggling to keep up with the technology evolution, regulators will be focused on saving the global economy rather than a specific industry. Amongst other reasons, it will naturally decrease the pace at which public authorities will make game-changing decisions. It is also in my view a great time for them to reflect on what worked and what did not (i.e. trials of AVs, e-scooters, ridesharing, etc…).

Infrastructure

Similarly to technology, we can expect a decrease in infrastructure investments in this $3.7 tn yearly revenue market. Moreover, it seems to be a sort of step back in this part of the mobility industry to rethink how we should allocate the urban space. For example, 76 km of cycling space were added from one day to another in Bogota to facilitate social distancing. London together with Mexico are shifting from temporary decisions in favour of cycling space to permanent measures. Certainly, this is a short term break to restart the development faster and more aligned with people’s needs.

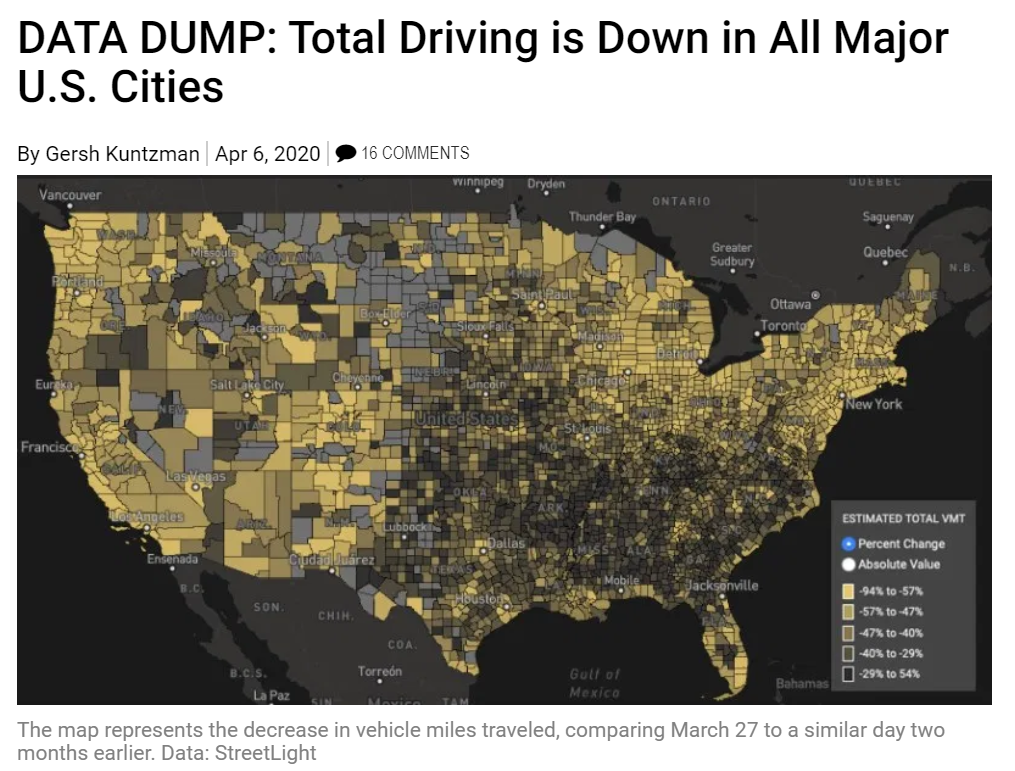

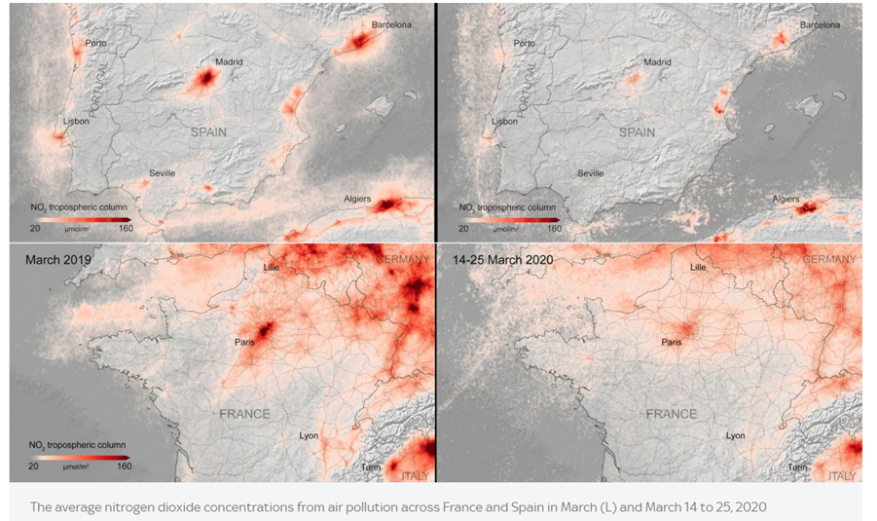

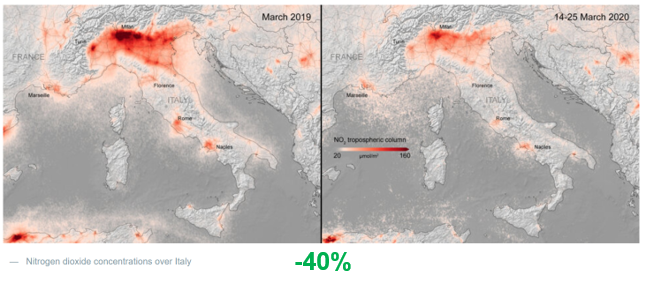

Pollution, congestion and people adoption were extremely difficult to change before the crisis. Now, there are significantly and positively impacted thanks to the coronavirus

Speaking of people, they are amongst the other drivers being congestion and pollution, that were extremely difficult to impact, to change and to improve in the short term. These factors are from one day to another drastically disrupted. I will spare you the “fascinating” analysis that there are fewer cars on our streets leading to less pollution and congestion. Just have a look through your front window and you’ll make your own judgment. But why do I include people in this list?

Because based on my latest pieces of research, people adoption is often underestimated by mobility stakeholders. We start seeing some results of this forgotten aspect in their strategy. A multitude of massive mobility operators around the world is either stepping out of some markets mostly due to a low utilisation rate or dramatically reconsidering their strategy to think in terms of value-added for people.

COVID19 is shifting the smart mobility debate from tech, regulation and infrastructure to what really matters: the end-users

Indeed, I feel like the COVID19 crisis is, at last (!), shifting the smart and urban mobility debate from technology, regulation and infrastructure to us, the end-users. We are now realising that at the end of the road, if there is no human using mobility services, there is no service at all!

So, the question people are asking around: who are the winners and the losers against the COVID19? Who gets sick, who goes viral?

And the winners are… Earth, urban logistics, a part of micromobility and autonomous vehicles. Congratulations 👏

The winners

The Earth! Some images are worth better than lengthy descriptions, so here there are:

In terms of mobility services, I also include as winners urban logistics, a part of micromobility and autonomous vehicles.

We were already experiencing an impressive growth in urban deliveries… this was just the beginning!

Urban logistic is another part of the industry getting incredible benefits from the virus outbreak. People are trying new ways of shopping, eating and doing errands which are in my view the beginning of a serious consumer behaviour shift leading to an exponential growth of urban deliveries.

E-scooters: The house is on fire, but I keep repeating that the spark was generated well before the virus due to a poor consideration for end-users

Micromobility, including active transports such as walking, is also somehow listed in the winners. Except scooters who are getting dramatically hit, the other modes of transport focused on the first and last mile seem to do great. Just for your information about how the situation is critical for e-scooter companies, Bloomberg reported that Lime could be bankrupt in twelve weeks (as of the 08/04). In Paris alone, which the largest single market of Lime mid-March 2020, the number of rides fell by 98 per cent in three days. Moreover, according to Techcrunch beginning of this month, 406 of 1,387 employees had to leave the e-scooter company Bird. The house is on fire, but I keep repeating that the spark was generated well before the virus with a poor consideration for the value-added to the end-users.

Last but not least, the part of the mobility world which in my view is getting the most out of this crisis is the autonomous transportation. What was perhaps considered by some as a fancy futuristic technology is now getting a unique chance to prove the great impact it can make on our society. In Asia, there is an increasing interest in urban autonomous good delivery with pilots from massive players such as JD.com with its first autonomous medical delivery beginning of February or Meituan Dianping piloting its first autonomous grocery delivery for people unable to go outside of their place.

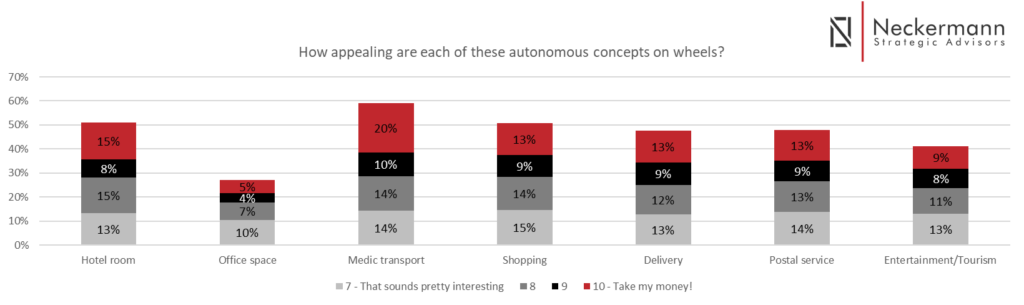

Also, think about the hospital system under pressure. In a survey for the study Being Driven we conducted at Neckermann Strategic Advisors, the respondents said that “medic transport” would be one of the most preferred usages of an AV.

So why not save the time of our heroes (i.e. the ambulance drivers and doctors) with driverless ambulances? The Mayo Clinic in Jacksonville in Florida understood this benefit are using self-driving shuttles to transport coronavirus tests from a drive-in testing clinic to the processing lab. In another word… Bravo!

The others

Electric vehicles, shared mobility and car manufacturers are living hard times…

There are winners and there are… others. I’d like to keep this article with a positive spirit, so I am not going to detail this section (perhaps in another article?).

My opinion is the electrification of mobility is severely damaged by this crisis on a short-term basis. There’s no point to list all the factors supporting this statement (more than happy to discuss them if you want) but there are obvious points such as the low gas price or the survival mode of OEMs that would probably refocus resources to current and not future models. Public transports are also losing a lot during the outbreak but it is temporary. MaaS and more specifically ride-hailing and carsharing companies are quite negatively impacted. I do hope it will, at last, be the trigger to push companies to think about specific shared vehicles. In other words, cars that we will enjoy sharing with others. Look at the below picture, isn’t that ridiculous?

It should have been long ago that protective and comfort features for the drivers and passengers were implemented in ridehailing vehicles

⬆ This is ridiculous ⬆

It should have been long ago that protective and comfort features for the drivers and passengers were implemented in ridehailing vehicles. Perhaps should we talk about shared AND protected mobility?

Sincerely, well done to the ingenious people installing these safety solutions to balance what mobility stakeholders failed to consider (and develop) seriously 👏!

Is shared AND protected mobility a new requirement to fit end-user expectations?

Again, the mobility industry has underestimated that in the vehicles, the users are living bodies, feeling emotions and frustrations. Speaking of emotions, how will people behave regarding shared services after the crisis? I am not even particularly talking about mobility but in general, how the coronavirus will impact the shared and circular economy? I do not know and it is too early for me to have an opinion. So if you have insights, I’d love to hear from you.

Nevertheless, thanks to the COVID19, we are now putting the focus on what really matters: you, me, our family, friends and future generations!

For OEMs the house was already smelling smoke and it seems there is an additional fire start with the crisis

Finally, OEMs are the ones in my view amongst the most negatively hit for a long period. The house was already smelling smoke and it seems there is another fire start now.

The future of mobility post-crisis? I have no idea, but…

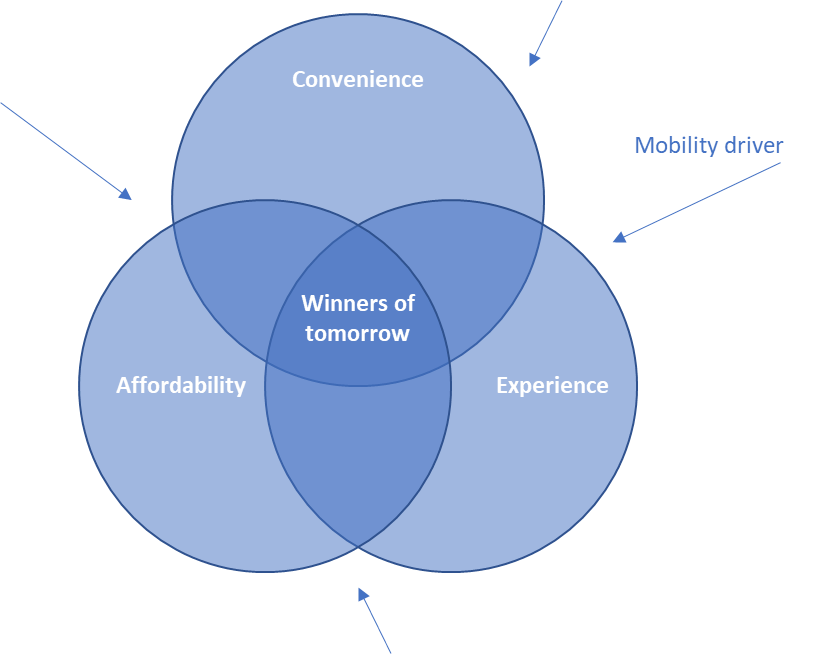

To conclude this article, what will the future of mobility be after this crisis. Personally, I have no idea. The only thing I am sure is the mobility behaviour of people is driven by 3 factors: convenience, experience and affordability (see the blue circles in the below picture). It seems that these factors are temporary put on hold on their side. This is why we see an increase in cycling or walking and fewer taxi rides, … But soon enough, they will govern back the end-user behaviours.

While navigating in a changing industry, who will be able to position itself in the middle of the people’s drivers?

Mobility drivers, impacted by the crisis, will influence the behaviour drivers of people (blue arrows in the above picture). There will be a before and an after COVID19. The question is, who will be able to position itself in the middle of the people’s drivers while adapting its strategy to the post-crisis mobility environment?

Wow, I am already excited to be tomorrow! 🤗

As always, please feel free to share your opinion and engage with me!

The views expressed in this article are personal and do not represent the opinion of my employer or any other parties I am involved with. The suggested insights come from discussions, research and analyses.